What are the Deductions Allowed for Tax Payer in Income Tax, What is the Section 80 of Income Tax 1961, What are the Deductions you can claim under Section 80 and Income Tax Deduction Under Section 80C are the few Questions which is being asked all the Time.

Here in this Article we are Deducing all the various deductions a taxpayer can claim from his total income which would bring down his taxable income and thereby reduce his tax outgoing.

This Article is not only Important for a Tax Payer for also for all the Banking and Finance Student who Aspires to Under these Complex Income Tax System to help Understand Others. Along with this Article we are Basics of Income Tax Guide PDF Download for Free.

Income Tax Deduction Under Section 80 of Income Tax Act, 1961

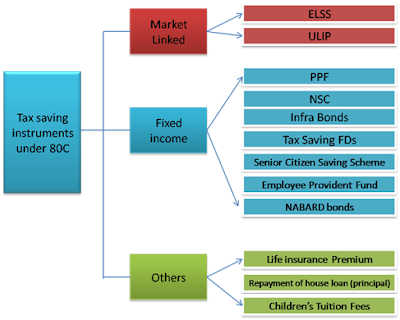

Income Tax Deduction Under Section 80 C

- Term Plan

- EPF (Employees Provident Fund)

- PPF (Public Provident Fund) & Sukanya Samridhi Scheme

- ELSS (Equity Linked Saving Scheme)

- Home Loan

- Tuition Fee

- NSC (National Saving Certificate) & SCSS (Senior Citizen Saving Scheme)

Union Budget 2019-20 Highlights : Changes in Tax Collection

Finance Minister Piyush Goyal in Budget 2019 proposed many changes in income tax rules for the year 2019-20. Besides higher standard deduction, he also proposed no tax on income up to ₹5 lakh. At present, income up to ₹2.5 lakh is exempt from personal income tax. Income between ₹2.5 and ₹5 lakh attracts 5% tax, while that between ₹5 lakh and ₹10 lakh is taxed at 20%. Income above ₹10 lakh is taxed at 30%.

Budget 2019: Here are 5 changes proposed on the Personal Income Tax Front

- The rebate under Section 87A of the Income tax Act, 1961, has been raised to ₹12,500. It is only applicable for those with net taxable income of up to ₹5 lakh. A rebate is the amount of tax the taxpayer is not liable to pay. So in the next fiscal year, if an assessee has a net taxable income of up to ₹5 lakh, he/she is allowed to claim the entire tax payable as tax rebate. For instance, if an assessee has a gross income of ₹6.5 lakh for the financial year 2019-20, and makes an investment of ₹1.5 lakh under Section 80C, his/her net taxable income comes down to ₹5 lakh, on which his/her tax liability will be ₹12,500 (5% of ₹2.5 lakh), excluding cess (income up to ₹2.5 lakh is exempt from tax). Against this, a rebate of ₹12,500 will be available and, thereby, the net tax will come down to zero.

- Standard deduction increased from ₹40,000 to ₹50000. A standard deduction reduces your taxable income, thereby reducing your tax liability. Standard deduction was re-introduced last year. This increase of ₹10,000 in standard deduction will result in tax savings of ₹3,000 for individuals in the 30% tax bracket (excluding surcharge and cess).

- In the Budget, the finance minister proposed exemption from notional rent in respect of two self-occupied house properties. Currently, if a person has two properties which are self-occupied, deemed rent from one of the house properties is taxable.

- The finance minister also proposed to extend the one-time benefit of capital gains exemption on reinvestment in two house properties. This benefit will apply where capital gains are ₹2 crore or less. Currently, the exemption is applicable only against one house property.

- The threshold on TDS on interest from bank or post office deposits has been increased to ₹40,000, from current limit of ₹10,000. This means interest income on bank/post office deposits up to ₹40,000 will not be subject to TDS.

Union Budget 2019-20 Sector Wise Important Highlights - View & Download

Top Government Schemes Announced in Union Budget 2019-20 - View & Download

Ombudsman Scheme for Digital Transactions Launched by RBI - View & Download

List of Financial Regulators in India - RBI, SEBI, PFRDA, IRDAI - View & Download

Important Management Theory for RBI Grade B Management Paper - View & Download

Major Provisions of Negotiable Instruments Act 1881 PDF Download - View & Download

Major Provisions of Reserve Bank of India Act 1934 PDF Download - View & Download

Banking Regulation Act 1949 and Important Sections PDF Download - View & Download

You can Also Read and Download Banking Awareness Books & PDFs

Complete Banking Awareness Capsule PDF Free Download - Download

Banking Awareness Hand Book PDF Free Download - Download

Banking Awareness Questions PDF Free Download - Download

1200+ Banking Awareness MCQs PDF Free Download - Download

Static Awareness Capsule PDF Free Download - Download

List 50 Central Government Social Scheme Launched PDF - Download

200 Important Banking Abbreviation Capsule PDF - Download

State Wise Static Awareness Book PDF Free Download - Download

Stay updated with us for more study materials for all competitive exams.

Click here to Join our Telegram Study Group

Click here to Like our FACEBOOK Page

bank4success is one of the fastest Growing Educational Channel for Banking and Insurance Exam.If Our Services and Posts has helped you in your Preparation then Please Support us to Grow and help us to connect with Your Friends and their friends also.

Like, Share & Subscribe Our Various Social Media Channel.

Disclaimer - Some of the Information and Images were taken from ClearTax Website as they are Pioneer in this Field and have reliable source of Information. These Information taken are solely for Education Purpose. If ClearTax Team Believes this is Copyright Infringement, we would be happy to remove this page.

0 Comments